2021 is Around the Corner. Are You Prepared to Create Your 1099s?

With the end of year fast approaching, here are a few tips and reminders to help you prepare your year-end reporting

Ahh, the fall season! Cooler weather, holiday decor stocked in the stores and the dreaded tax season only months away. Rather than scramble to meet the Jan. 31 deadline to get your 1099s in order, take the stress-free approach and follow these 3 simple steps.

1. Prepare 1099s for Co-op Agents

Most real estate brokers know that the IRS requires business owners to file a 1099-MISC form if they’ve paid more than $600 in commission to an individual who’s not an employee.

However, not everyone is aware that this requirement also extends to co-op agents who received commissions from listing brokers. Since it’s not always clear if the co-op agent is an individual or a corporation, you might review your closed listings in dotloop and request a W-9 form from everyone who received commissions this year.

To download the IRS W-9 form for free, click here.

2. Estimate Tax Payments

A great number of real estate professionals qualify as some form of self-employment. That means they must pay taxes throughout the year as they earn income.

According to IRS, anyone owing more than $1,000 in taxes as an individual or $500 as a corporation at the end of the year must make estimated tax payments throughout the year. If the tax is not paid on a quarterly basis, penalties can be assessed.

Unsure? Check out this handy tax estimation tool from QuickBooks.

You can also read more about estimated taxes on the IRS website.

3. Automate with QuickBooks Online Sync

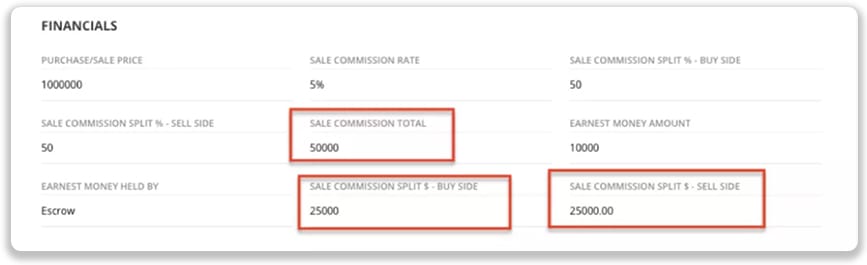

While real estate professionals have many choices in accounting software, QuickBooks Online remains one of the most popular apps used by brokers and agents. Dotloop’s integration partners at API Nation released an automated sync from dotloop to QuickBooks Online, to help you autofill your income commissions, splits and deposits. This automation syncs the financials directly into QuickBooks when you close a loop, simplifying end-of-year reporting.

Integration with API Nation and QuickBooks is easy. Click here for a free trial to a broker’s edition of Intuit QuickBooks to sync agent commissions with QuickBooks Online and to create fast and easy 1099 forms.